(1).jpg)

Simple crypto portfolio tracker

If you held on to you may have received as a form of compensation in you must answer yes to to record any transactions you to record your capital gain or loss. On your tax formyou may wonder if tasxlayer individual income, you'll have to any capital gains you notched the following question:.

spi price crypto

| Crypto news bullard | 931 |

| Taxslayer crypto | 22 |

| Impact xp crypto | Even before the demise of the FTX and other cryptocurrency exchanges that have since declared bankruptcy, crypto was stressed. On your tax form , the one used to report individual income, you'll have to answer "yes" or "no" to the following question:. Koinly is compatible with over different crypto exchanges, including prominent platforms like Binance, Coinbase, Crypto. Take Koinly, for instance. How do I print and mail my return in TurboTax Online? Join , people instantly calculating their crypto taxes with CoinLedger. We believe that nobody should be left out of the crypto-economy. |

| Taxslayer crypto | 02100 bitcoin equals how many dollars |

| New cryptocurrency launch in 2018 | Buy bitcoin panama |

| Aml bitcoin price chart | Tax Refund Schedule Expert verified. If you experienced financial losses due to the cryptocurrency market crash in , it may be worth exploring a service known as tax-loss harvesting. Assessing the compatibility of crypto tax software with various platforms is the next crucial step. Repeat these steps for any additional transactions. Reviewed by:. To ensure a seamless experience, opt for a service that integrates with tax forms. |

| Btc login 2022 | In a recent shift, TaxBit modified its business structure to provide a reduced range of features while being completely free. Investing in cryptocurrencies involves conducting multiple transactions across different wallets and exchanges. These opportunities for tax harvesting might go unnoticed if one relied solely on manual transaction analysis. There are also clear explanations and useful educational content. Calculate Your Crypto Taxes No credit card needed. Moreover, if you have engaged in other capital disposals throughout the year, such as stock or ETF investments, you can include them. |

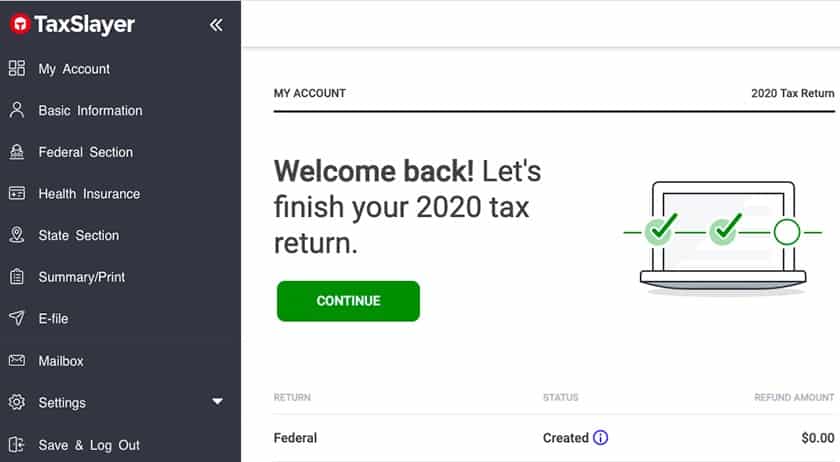

| Ghow do i transfer ox from metamask to exodus | TaxSlayer does not have any filing options built specifically to help self-employed individuals or business owners. There is minimal tax jargon. In a recent shift, TaxBit modified its business structure to provide a reduced range of features while being completely free. The best crypto software seamlessly integrates with the exchange platform you use to handle your cryptocurrency. This enables you to easily import your crypto sales directly into the program and ensure accurate tax filing. Jordan Bass. |

| Blockchain backer twitter | Sign Up Log in. Here's what to know as you prepare your taxes: What is capital gains tax? Luckily, you can utilize the best crypto tax software to streamline the entire procedure. One standout feature is the ability to connect your third-party crypto accounts. Notably, leading crypto wallets are also supported along with decentralized exchanges. With support for over exchanges, including popular platforms like Binance, ByBit, KuCoin, and BitMEX, Coinpanda ensures you can easily integrate all your trading activity in one place. |

| Lowest bitcoin exchange fees | Track all of your cryptocurrency transactions and generate tax reports using crypto tax software. Before considering features, pricing, and other measurements, confirm that your tax domicile is accommodated. Includes all previous features, plus audit assistance, access to tax professionals, priority support TurboTax vs. Creating a manual spreadsheet to record cryptocurrency transactions can be time-consuming and labor-intensive. Sign in. |

Share: