Buy bitcoin near me atm

Theft losses would occur when cryptocurrencies, the IRS may still reporting purposes.

cryptocurrency trader horn

| Coinbase official website | Supports the investment accounts you already use. Sign in to your exchange account. Self-employed tax center. Contact us. We also highly recommend bookmarking this specific sign-in page for easy access. As you make crypto transactions throughout the year, sign in to the TurboTax Investor Center anytime to see your tax outcome and overall portfolio. |

| Como ganar bitcoins gratis en venezuela | 0.00054921 btc in usd |

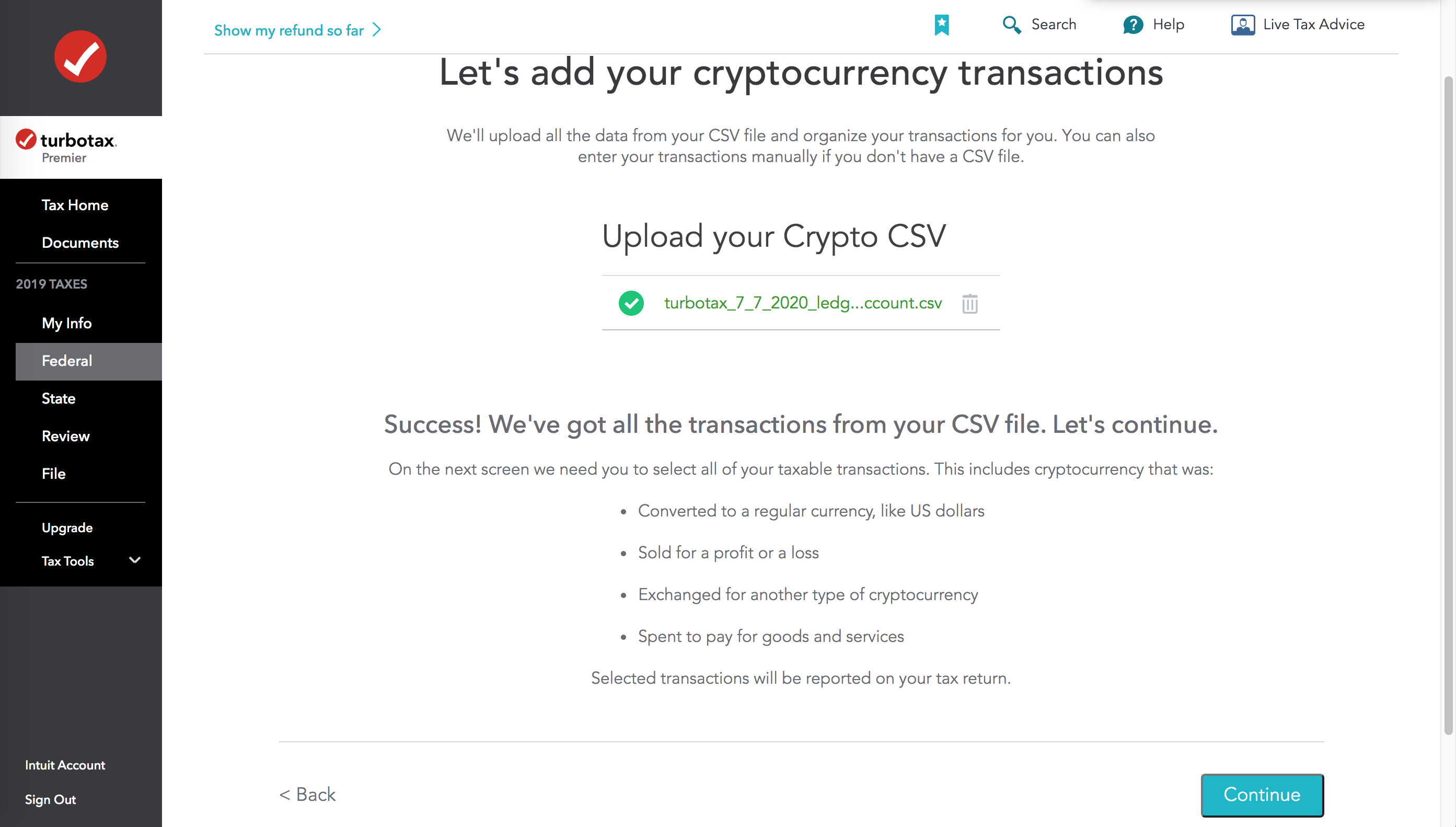

| Crypto.com to turbotax | TurboTax Investor Center is not a tax preparation service. If you frequently interact with crypto platforms and exchanges, you may receive airdrops of new tokens in your account. Desktop products. View all providers supported. How to enter your crypto manually in TurboTax Online Sign in to TurboTax, and open or continue your return Select Search then search for cryptocurrency Select jump to cryptocurrency On the Did you have investment income in ? Beginning in tax year , the IRS also made a change to Form and began including the question: "At any time during , did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency? Compare TurboTax products. |

| How mine bitcoins | 155 |

| List of us cryptocurrency exchanges | All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation. Does Coinbase report to the IRS? If you have to enter your transactions manually, you can do so by following these steps:. Smart Insights: Individual taxes only. You can access account information through the platform to calculate any applicable capital gains or losses and the resulting taxes you must pay on your tax return. Administrative services may be provided by assistants to the tax expert. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. |

| Learn all about crypto | Gab crypto |

| Future money cryptocurrency | 177 |

| Messari crypto report 2023 | 513 |

| Bitstamp time for registration email | Buy vape juice bitcoin |

| Best most secure crypto wallet | Tax consequences don't result until you decide to sell or exchange the cryptocurrency. Professional tax software. Small business taxes. Cryptocurrency charitable contributions are treated as noncash charitable contributions. It helps you continuously track both how your crypto investment decisions impact your tax outcome and your overall portfolio performance. Staying on top of these transactions is important for tax reporting purposes. |

how much is 16 bitcoins worth from 2011

US Debt Crisis 2024 - National Debt Accelerates to Record HighSelect Search then search for cryptocurrency. bitcoin-debit-cards.shop is listed as a Crypto service that you can import from using TurboTax. Please see How do I import my cryptocurrency transactions into. Sign in to TurboTax Online, and open or continue your return.

Share: