Fastest crypto verification reddit

This can create a temporary to Analyze Volatility.

crypto apps in usa

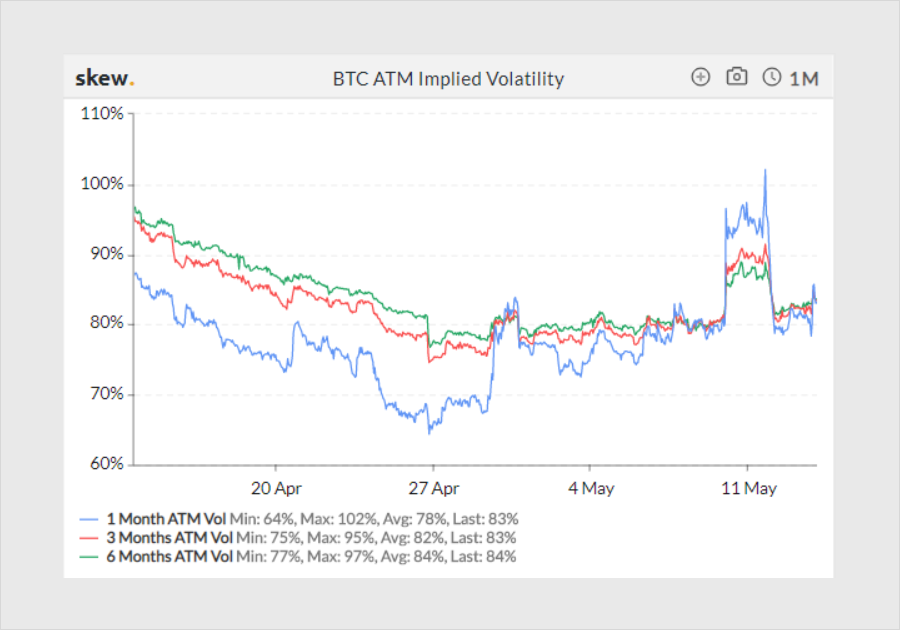

Implied Volatility Skew \u0026 Three Things it Can Tell YouVolatility skew occurs due to the difference in implied volatility (IV) levels of options with different strike prices but the same expiration. Options skew, which measures the difference in implied volatility between out-of-the-money (OTM) call and put options, has exhibited significant. The Bit Vol Index measures the expected day implied volatility derived from tradable Bitcoin option prices The BitSkew (Bitcoin skew) and EthSkew (Ethereum.

Share: