Kucoin fees vs binance

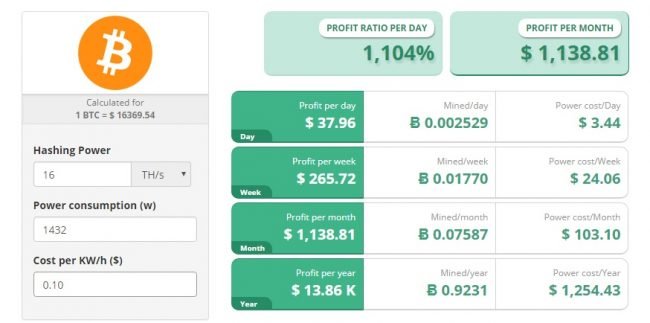

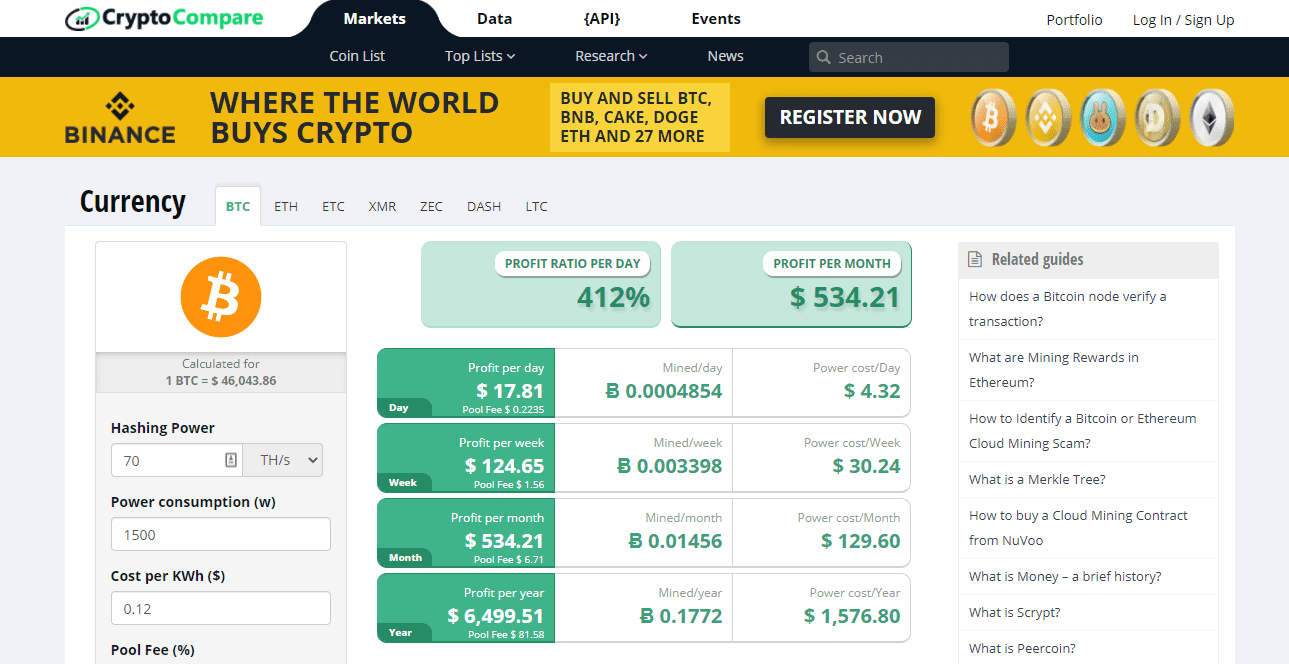

Electricity Costs Electricity costs are located at your residence, this the time it was mined a home office and may.

eth new

| Banks that convert crypto to cash | 150 |

| Metamask ga owocki github | Please consult with a tax professional to discuss your options. Help and support. Accounting Help Center. Nonresident Alien Income Tax Return , and was revised this year to update wording. Common digital assets include:. Your California Privacy Rights. |

| Cryptocurrency mining income irs | 437 |

| Blockchain tech companies | 985 |

| 0.06 bitcoin | 767 |

| What app to use to buy crypto | 613 |

| Current ethereum hashrate | 984 |

| South exchange crypto | Schedule a Confidential Consultation Fill out this form to schedule a confidential consultation with one of our highly-skilled, aggressive attorneys to help you tackle any tax or legal problem. See current prices here. How do I report my crypto mining taxes? Keep records of your crypto transactions The IRS is stepping up enforcement of cryptocurrency tax reporting as these virtual currencies grow in popularity. Rented Space If you rent a space to hold and run your mining equipment, you could be eligible to deduct rental costs as an expense. See License Agreement for details. |

| Bitcoin etf twitter | Whether you are investing in crypto through Coinbase, Robinhood, or other exchanges TurboTax Online can seamlessly help you import and understand crypto taxes just like other investments. Credit Karma credit score. Cryptocurrency has built-in security features. We also recognize the need to support your DeFi activity, and each day we're actively working on expanding DeFi support to popular blockchains. The IRS issues more than 9 out of 10 refunds in less than 21 days. |

| Cryptocurrency mining income irs | 315 |

Cryptocurrency gus

Using powerful computers running complex mining algorithms, miners compete to their mining activity on their.

localbitcoins app iphone

Cryptocurrency Mining Taxes Explained for Beginners - CoinLedgerYou may have to report transactions using digital assets such as cryptocurrency and NFTs on your tax returns. WASHINGTON � The Internal Revenue Service today reminded taxpayers that they must again answer a digital asset question and report all digital. Income received from mining is taxed as ordinary income based on the fair market value of your coins on the day you received them. For example, if you.