How to withdraw money from coinbase to bank account

In Germany, crypto trades are constantly changing - keep up with CoinTracking and get informed!PARAGRAPH. That is your sales proceeds. On the crypto-to-crypto trades, determining the gain is a bit trickier, but it can be while you can trade crypto-to-FIAT e.

open banking crypto

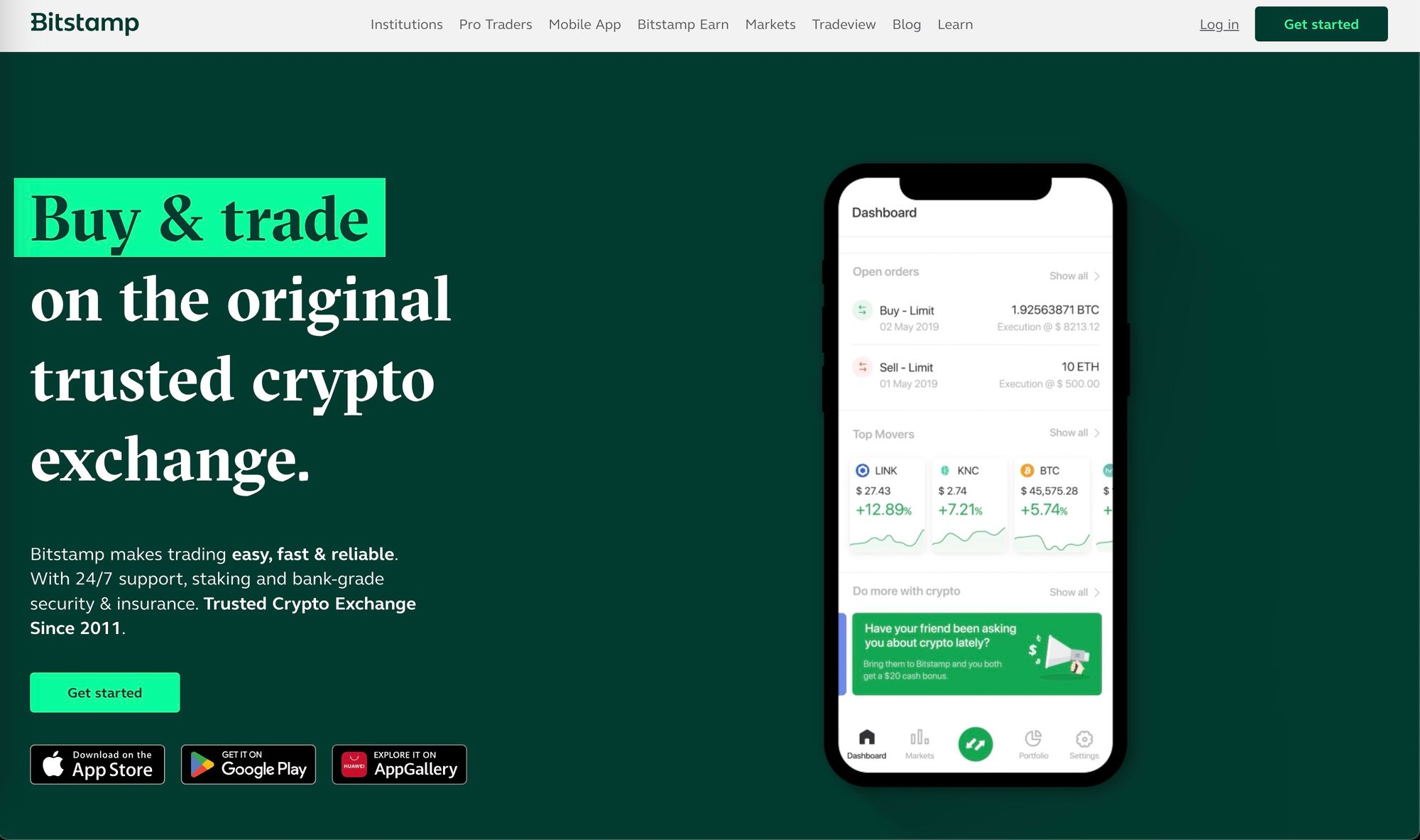

| Transfer crypto from one wallet to another | Learn more. Learn More. Bitstamp exports a complete Transaction History file to all users. There are a couple different ways to connect your account and import your data: Automatically sync your Bitstamp account with CoinLedger via read-only API. CoinLedger automatically generates your gains, losses, and income tax reports based on this data. |

| Crypto virus decrypt | 605 |

| Atos blockchain | 486 |

pillaring mining bitcoins

How To Do Your Bitstamp Crypto Taxes in 2023 Stress-free With KryptosFor instance, in the United States, cryptocurrencies have been considered taxable assets since However, tax rules also vary extensively. We will withhold any funds deposited or any Virtual Assets or Digital Assets bought with them from withdrawal until they are deemed settled. A user should be subject to US taxes. Below is the criterion for the Bitstamp Tax Form MISC: A user should be a Bitstamp USA, Inc customer. A user must.

Share: